Most recruitment agencies operate surrounded by a wealth of potentially valuable information. Every placement history, candidate resume, interview note, client job description, and feedback loop contains insights waiting to be uncovered. Yet, this data often remains scattered, unstructured, and under-leveraged, essentially digital noise rather than a strategic asset.

Data only transforms into an asset when it's structured and connected. By unlocking the intelligence hidden within their existing systems through more intelligent data management and adopting a skills-first lens, recruitment firms can gain significant competitive advantages and redefine their value proposition. This guide explores the untapped potential within agency data and outlines the shift required to harness it.

The Data Goldmine

The daily operations of recruitment agencies generate vast amounts of data, often hiding in plain sight.

Data in Disguise

Consider the information already flowing through your agency: Detailed placement records showing who was hired, for which role, at which client, and potentially for how long; candidate resumes filled with experience and qualifications; interviewer notes capturing nuanced assessments; historical job descriptions outlining client needs; and feedback from both clients and candidates post-placement. Each successful match, even unsuccessful ones, contains valuable clues about hiring patterns, skill combinations that lead to success, benchmark salaries, and client preferences.

But Without Structure, It's Just Noise

The challenge lies in the structure or lack thereof. If this information exists only in isolated emails, disparate spreadsheets, or basic ATS fields without consistent tagging, it remains unusable mainly for strategic purposes. Without a system to classify roles, tag candidate skills using a consistent taxonomy, or link placement outcomes back to sourcing channels and candidate attributes, the data remains fragmented noise. Its potential to inform strategy, predict trends, or improve placement quality is lost because it cannot be effectively searched, aggregated, or analyzed.

The Blind Spot in Recruitment Agency Data

Fragmented Insights

Relying on manual tracking methods, disconnected spreadsheets, or siloed CRM/ATS systems prevents a unified view of talent and client activity. Recruiters often operate reactively, searching for candidates for each new req from scratch rather than leveraging historical data or proactively identifying pipeline candidates. This fragmented approach makes it impossible to see broader patterns or predict future needs, keeping the agency in a reactive cycle.

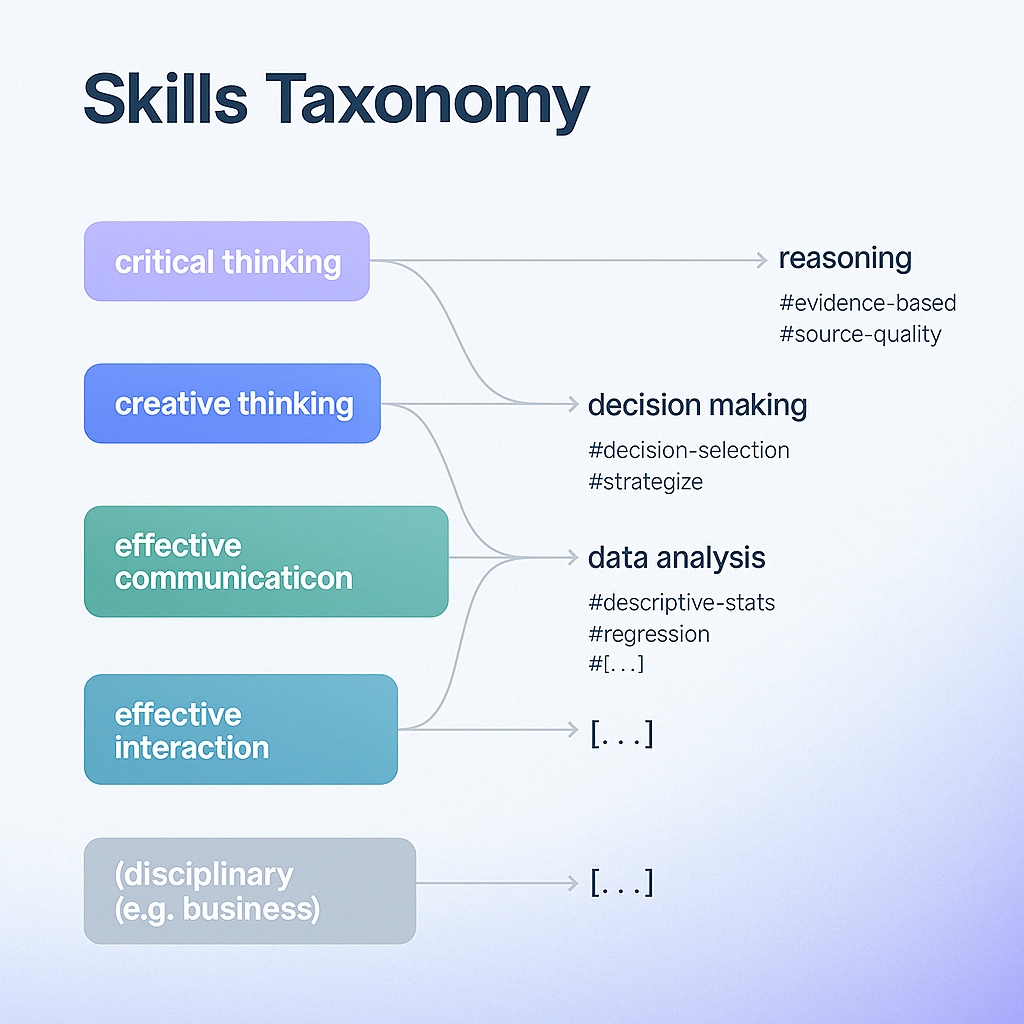

No Skill Taxonomy

Without a standardized way to define and track skills, a skills taxonomy, agencies cannot effectively analyze market demand or talent supply trends. They struggle to identify which specific skills are becoming more critical across their client base, which are declining, or how skills cluster together in successful placements. This prevents agencies from proactively advising clients on evolving needs or focusing their candidate sourcing efforts on high-demand skill areas.

Missed Opportunities

This data blindness leads to tangible missed opportunities. Agencies might unknowingly duplicate sourcing efforts for similar roles across different clients. They risk making suboptimal placements ("mis-hires") because they lack historical data linking specific skills or candidate profiles to long-term success in similar roles. Crucially, they miss chances to provide higher-value advisory services to clients, such as identifying potential reskilling needs within a client's candidate pool or advising on realistic skill requirements based on market availability insights readily available if the data were structured.

For example, an agency might not realize that a significant percentage of candidates placed into a specific role consistently require additional upskilling post-hire until client feedback highlights a pattern months later.

Opportunities from Existing Data

The missed opportunity extends beyond individual placements. Industry analysts highlight significant strategic leakage due to poor visibility into talent flows. While specific data varies, companies often hae high rates of external hiring even when internal candidates (or in an agency's context, previously placed or known candidates) might be suitable, mainly because organizations lack insight into existing talent capabilities.

Agencies mirror this internally; potential high-quality candidates already within their system are often overlooked in favour of new searches simply because their skills and potential aren't properly tagged and visible.

Agencies Could Be Sitting on Retention, Upsell & Forecasting Power

This existing candidate data holds immense potential value beyond immediate placements. Structured data on candidate skills, career trajectories, and placement outcomes allows agencies to forecast market trends, advise clients more strategically on workforce planning, and significantly speed up future placements. Agencies frequently miss crucial client advisory moments like proactively suggesting candidates with adjacent skills for upcoming needs or warning about unrealistic skill demands simply because the necessary insights weren't surfaced from their own unstructured data.

From Tracking to Connecting: The Data Shift Agencies Must Make

The path forward isn't about collecting more data; recruitment agencies already track vast amounts. The crucial shift is from merely tracking isolated data points to actively structuring and connecting them to generate intelligence.

Focus on Building Structured Data

Implement systems and processes to consistently tag and categorize information. Map placements back to specific job requirements, essential skills demonstrated by the candidate, the sourcing channel used, client industry, and placement outcomes (like tenure or client satisfaction). Create connections between candidates, roles, skills, and clients. This structured approach transforms raw data into a queryable, analyzable asset.

Turn Data Into Advisory Insight

Structured data reveals patterns invisible in spreadsheets. Analyze which clients consistently hire for specific skill clusters. Identify emerging skill demands based on recent job descriptions across your client base. Track average placement tenure by role type or skill set to understand long-term success factors. Use these insights to move beyond transactional placements towards providing strategic advice to clients on talent trends, realistic role requirements, potential upskilling needs within their teams, and anticipating candidate mobility.

Skills-Based Hiring is the Unlock

Organizing your talent data around skills, rather than just resumes or past job titles, is the fundamental unlock for higher value. A skills-first approach to data management enables more accurate candidate-role matching based on verified competencies. It allows for proactive reactivation of candidates in your pool when roles requiring their specific skills arise. It even facilitates recommending strong candidates initially sourced for one client to another client with similar skill needs, maximizing the value of your sourcing efforts. This focus improves placement quality and speed.

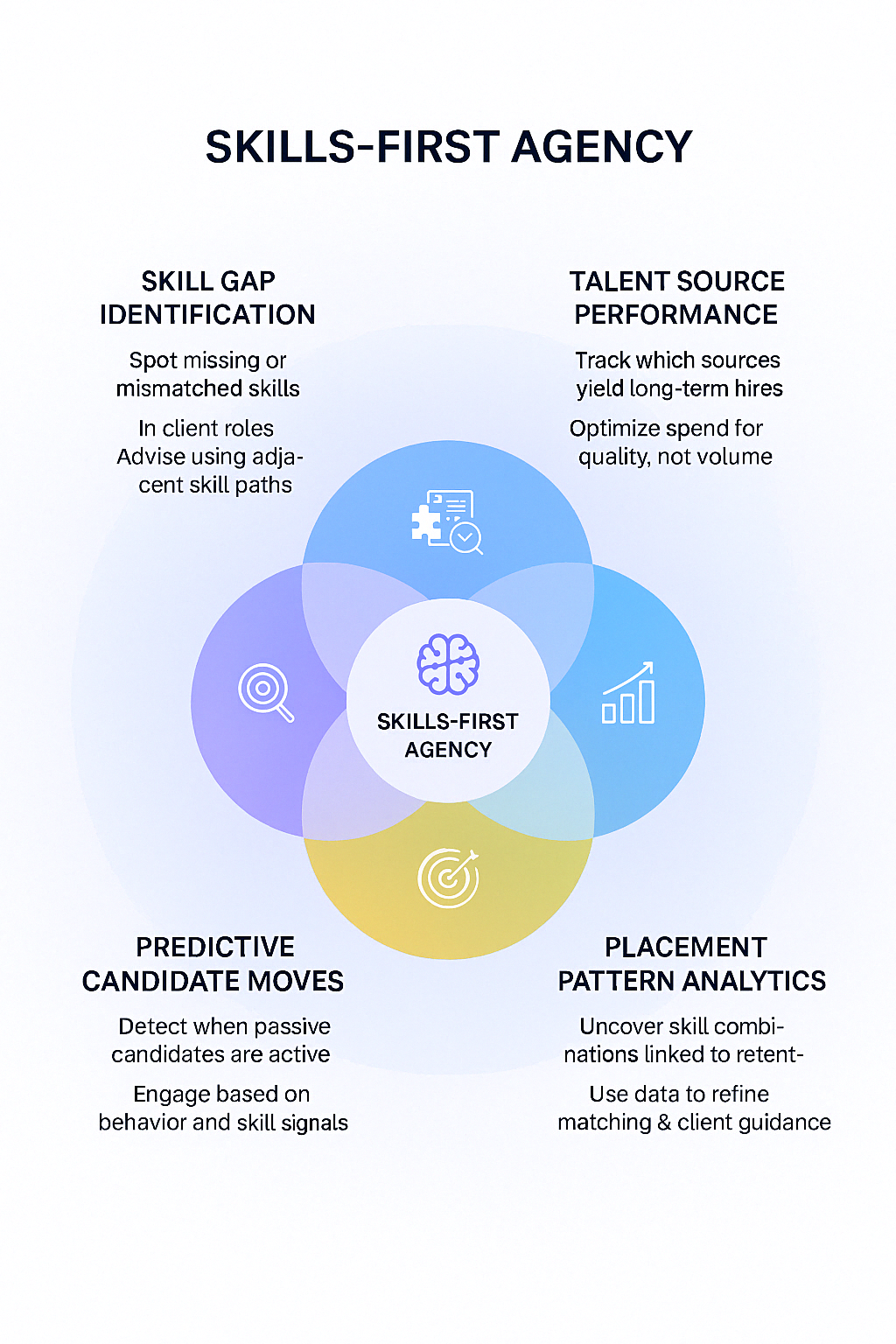

What Intelligence Looks Like in a Skills-First Agency

When data is structured around skills and connected across placements, clients, and candidates, agencies can generate powerful, actionable intelligence:

Skill Gap Identification (Client-Level)

Analyze a client's recent job requisitions against market data and your placement history. Identify potentially missing skills in their requests or skills they consistently struggle to hire for. Proactively propose sourcing strategies or suggest adjacent skills that might yield more available candidates, offering true consultative value.

Talent Source Performance Analysis

Move beyond simply tracking which source delivered a candidate. Analyze which sourcing channels (referrals, specific job boards, direct sourcing, LinkedIn) consistently yield candidates who get placed and succeed long-term (measured by tenure or client feedback) for specific roles or industries. Optimize sourcing spend and effort based on proven quality, not just volume.

Placement Pattern Analytics

Analyze historical placement data to understand patterns related to success and retention. Do candidates with certain skill combinations stay longer in particular roles? Does tenure vary significantly by client industry or company size? Use these insights to refine matching criteria and advise clients on retention factors.

Predictive Candidate Moves

Leverage data signals within your talent pool, such as frequency of profile updates, acquisition of new skills or certifications (digital credentials ), typical tenure in past roles, or connections engaging with new opportunities, potentially augmented by AI tools. These signals can help predict when promising passive candidates are receptive to outreach, allowing for timely, targeted engagement.

Why This Matters Now More Than Ever

The recruitment landscape is evolving rapidly. Leveraging internal data intelligence is becoming critical for agency survival and growth.

Competition is Tight, but Differentiation is Data-Driven Insight

Basic AI sourcing tools and large candidate databases are becoming table stakes. Agencies cannot differentiate themselves solely on reach anymore. True differentiation comes from providing unique insights derived from well-structured data. Clients increasingly seek partners who offer market intelligence, strategic advice, and evidence-based recommendations, not just resumes. Agencies that harness their internal data effectively can provide this higher level of service.

Structured Data Leading to Strategic Value

Transforming unstructured data into structured intelligence allows agencies to elevate their client relationships. Instead of just filling open reqs transactionally, they can help clients proactively plan their workforce, understand skills trends, benchmark roles, and improve retention. This shift moves the agency from a simple vendor to a strategic talent partner, fostering deeper, longer-term relationships. Adopting skills-first data practices is central to delivering this strategic value.

Conclusion

Recruitment agencies possess a hidden asset of immense potential: the vast amount of data generated daily. However, it remains largely untapped without structure, connection, and analysis through a skills-first lens. The challenge isn't acquiring more data or fancier tools; it's about implementing the data management discipline and technology required to see the patterns and intelligence within the data agencies already have. Agencies can unlock powerful insights by structuring data around skills, analyzing placement outcomes, tracking candidate engagement, and identifying trends. This intelligence fuels faster, higher-quality placements, enables proactive client advisory, and provides a competitive advantage in a crowded market. Structured data intelligence is your agency's next competitive frontier; the time to build the infrastructure that offers genuine insight is now.

About Hireforce

Originally built as a smart ATS and CRM (Customer Relationship Management) solution for Companies and Recruitment Agencies, we're now heading toward building an enterprise-grade AI Talent Intelligence Platform designed to future-proof businesses and career owners. We empower enterprises, SMBs, recruitment agencies, and individual talents through strategic talent insights and skill-first solutions. We integrate internal workforce data with real-time external market intelligence, enabling smarter, faster, and more confident talent decisions.