To strategically manage hiring, HR professionals rely heavily on data analysis, and at the heart of this are types of recruitment metrics. These metrics offer crucial visibility into the efficiency and effectiveness of talent acquisition processes. However, the sheer volume of available metrics can be difficult to navigate.

Understanding how to classify types of recruitment metrics is essential for HR departments aiming to optimize their strategies. By categorizing these metrics, organizations can gain actionable insights, diagnose areas for improvement, and ensure recruitment efforts directly contribute to business objectives.

In this article, Hireforce has listed down 5 key classifications that provide a framework for analyzing recruitment data and driving impactful results. Let’s explore what they are how to apply now.

» Introduction to Recruiting metrics - Guideline & FAQ

» What are recruitment metrics? 12 most frequently used metrics

1. Classifying by Business Objective - Align recruitment with strategic goals

To truly understand the impact of your recruitment efforts, it's crucial to view metrics through the lens of your overarching business objectives. This classification method ensures that your talent acquisition strategy is directly contributing to key organizational priorities. By categorizing metrics by objective, you gain clarity on how recruitment impacts vital areas like cost management, time efficiency, candidate quality, experience, and diversity.

1.1. Cost Efficiency

In competitive landscape, optimizing recruitment spending is paramount. Cost-efficiency metrics help you understand the financial investment required to bring in new talent and identify areas for budgetary optimization.

- Cost per Hire: Measures the average cost to hire a new employee. Because knowing your cost per hire helps you manage budgets and compare efficiency across different periods or departments.

- Cost to Fill: Calculates the total expenses associated with filling a specific vacancy. Because understanding the fully loaded cost of filling roles allows for better resource allocation and project budgeting.

- Sourcing Channel Cost: Tracks the expenses related to each recruitment source (e.g., job boards, agencies, referrals). Because pinpointing the most cost-effective channels is crucial for optimizing your recruitment budget.

- Recruitment ROI (Return on Investment): Evaluates the overall profitability and effectiveness of your recruitment investments in relation to the value brought by new hires. Because ultimately, you need to know if your recruitment investments are generating a positive return for the business.

1.2. Time Efficiency

Speed in recruitment is often critical, especially for minimizing disruption and capitalizing on market opportunities. Time-efficiency metrics focus on how quickly you can move candidates through the hiring process and onboard them effectively.

- Time to Fill: Measures the duration from job requisition approval to job offer acceptance. Because minimizing time to fill is crucial for reducing vacancy costs and maintaining operational efficiency.

- Time to Hire: Tracks the time from candidate application to job offer acceptance. Because understanding time to hire helps optimize the candidate journey and reduce candidate drop-off.

- Recruitment Funnel Speed: Assesses the velocity at which candidates move through each stage of your recruitment funnel. Because identifying bottlenecks in your funnel allows for targeted process improvements and faster hiring cycles.

- Time in Process Step: Measures the duration candidates spend at each stage of the recruitment process (e.g., screening, interviewing, offer). Because understanding time spent in each step helps pinpoint specific areas where delays occur and processes can be streamlined.

- Time to Productivity: Tracks how long it takes for a new hire to reach full productivity in their role. Because minimizing time to productivity ensures new hires contribute value quickly, maximizing the return on your talent investment.

1.3. Quality of Hire:

Beyond speed and cost, the ultimate goal is to bring in high-performing individuals who contribute to the organization's success. Quality of hire metrics assess the caliber and long-term value of your new recruits.

- Quality of Hire: A composite metric (often subjective) evaluating a new hire's performance, contribution, and overall value to the company. Because quality of hire is the ultimate measure of recruitment success, reflecting the long-term impact of your hiring decisions.

- First-Year Attrition: Measures the percentage of new hires who leave within their first year of employment. Because high first-year attrition can signal issues with hiring quality, onboarding, or job fit, indicating areas for improvement.

- New Hire Turnover Rate: Tracks the percentage of new hires who leave within a defined period (e.g., 1-2 years). Because new hire turnover is a critical indicator of long-term hire quality and the effectiveness of your overall recruitment and onboarding processes.

- Hiring Manager Satisfaction: Gauges hiring managers' satisfaction with the quality of candidates provided and the recruitment process. Because hiring manager feedback is a valuable indicator of recruitment service quality and alignment with business needs.

- Candidate Job Satisfaction: Assesses new hires' satisfaction with their roles and the company post-hire. Because satisfied employees are more likely to be engaged, productive, and remain with the organization long-term, reflecting successful hires.

- Probation Passing Rate: Tracks the percentage of new hires who successfully complete their probation period. Because probation passing is a tangible early indicator of hire quality and job fit, providing a faster feedback loop than longer-term attrition.

1.4. Candidate Experience

Modern talent market observes the strong influence of candidate experience, which is surely a crucial differentiator. These metrics focus on measuring and improving the perception and satisfaction of candidates throughout the recruitment journey.

- Candidate Experience: A qualitative metric assessing candidates' overall perception and satisfaction with the recruitment process. Because a positive candidate experience enhances employer brand, attracts top talent, and minimizes candidate drop-off.

- Candidate Net Promoter Score (cNPS): Measures candidate loyalty and willingness to recommend your company as an employer based on their recruitment experience. Because cNPS provides a quantifiable measure of candidate sentiment and brand advocacy potential.

- Application Completion Rate: Tracks the percentage of candidates who complete the full job application process. Because a low application completion rate can indicate issues with application complexity, length, or user-friendliness, hindering candidate flow.

- Candidate Withdrawal/Rejection Reasons: Analyzes the reasons why candidates withdraw from the process or reject job offers. Because understanding these reasons provides valuable insights into process bottlenecks, compensation issues, or areas where candidate expectations are not being met.

1.5. Diversity & Inclusion (D&I) / DEI / DEIB:

Creating a diverse and inclusive workforce is a key business imperative. D&I metrics help you track progress, identify disparities, and ensure equitable hiring practices.

- Diversity & Inclusion (D&I) / DEI / DEIB Metrics: Encompass a range of metrics tracking representation of diverse groups across the candidate pool and hired employees (e.g., gender, ethnicity, disability, etc.). Because measuring diversity and inclusion is essential for building equitable workplaces, fostering innovation, and reflecting the diversity of your customer base and society.

- Candidate Diversity: Measures the representation of diverse demographic groups within your candidate pool at different stages of the recruitment funnel. Because monitoring candidate diversity at each stage helps identify potential bias and ensure equitable access and progression for diverse candidates.

- Adverse Impact: Analyzes whether any stage of your recruitment process disproportionately disadvantages certain demographic groups. Because identifying and mitigating adverse impact is crucial for legal compliance and ensuring fair and unbiased hiring practices.

2. Classifying by Level of Measurement: Activity, Efficiency, Effectiveness, Satisfaction

This "level of measurement" classification helps you analyze performance from different angles, moving beyond simple counts to understand efficiency, effectiveness, and satisfaction. By understanding these levels, you can gain a more nuanced perspective on your recruitment data, identify areas for improvement across different dimensions, and ensure you're not just busy, but also impactful and valued.

2.1 Activity Metrics:

Activity metrics provide a fundamental understanding of the volume and velocity of your recruitment process. They are focused on what is being done and how much activity is occurring. These metrics are often the easiest to track and provide a baseline for understanding overall process throughput.

- Number of Hires: Simply counts the total number of individuals hired within a specific period. Because knowing the number of hires is the most basic indicator of recruitment output and overall hiring volume.

- Number of Open Positions: Tracks the current number of unfilled job vacancies. Because monitoring open positions highlights immediate hiring needs and potential resource allocation requirements.

- Applicants per Role/Opening: Measures the average number of applications received for each job vacancy. Because applicants per role indicates the attractiveness of your open positions and the potential talent pool available.

- Selection Ratio: Calculates the proportion of candidates who move from one stage of the recruitment process to the next (e.g., applications to interviews). Because selection ratio helps assess the stringency of your screening process and identify potential bottlenecks in candidate progression.

- Fill Rate: Indicates the percentage of approved job requisitions that are successfully filled within a given timeframe. Because fill rate is a direct measure of recruitment effectiveness in meeting hiring demand and closing open positions.

- Offer Acceptance Rate: Measures the percentage of job offers extended that are accepted by candidates. Because a strong offer acceptance rate reflects the attractiveness of your offers and the competitiveness of your compensation and benefits packages.

- Application Completion Rate: Tracks the percentage of candidates who fully complete the online job application. Because a high application completion rate ensures a greater pool of candidates for consideration, while a low rate may signal issues with application usability.

- Test Completion Rate: Measures the percentage of candidates who complete pre-employment assessments or tests. Because test completion rate ensures that candidates progress through the selection process and provide necessary assessment data for informed decisions.

2.2. Efficiency Metrics

Efficiency metrics go beyond activity and focus on how well resources are being used and how quickly processes are moving. These metrics are about optimizing your recruitment engine for speed and cost-effectiveness.

- Time to Fill: Measures the duration from job requisition approval to job offer acceptance. Because minimizing time to fill reduces vacancy costs and ensures timely staffing to meet business needs.

- Time to Hire: Tracks the time from candidate application to job offer acceptance. Because reducing time to hire enhances candidate experience and minimizes the risk of losing candidates to competitors.

- Recruitment Funnel Speed: Assesses the velocity at which candidates progress through each stage of your recruitment funnel. Because a faster funnel speed indicates a more efficient process and quicker access to qualified talent.

- Time in Process Step: Measures the average time candidates spend at each stage of the recruitment process. Because identifying and reducing time in process steps helps streamline workflows and eliminate unnecessary delays.

- Cost per Hire: Measures the average cost incurred for each successful hire. Because minimizing cost per hire optimizes recruitment budget utilization and maximizes the value derived from recruitment spending.

- Cost to Fill: Calculates the total expenses associated with filling a specific job vacancy. Because understanding the fully loaded cost to fill helps in accurate budgeting and resource allocation for recruitment projects.

2.3. Effectiveness Metrics

Effectiveness metrics delve into the quality and impact of your recruitment efforts. They assess whether you are hiring the right people who contribute to organizational success over the long term.

- Quality of Hire: Evaluates the overall performance, contribution, and long-term value of new hires. Because quality of hire is the ultimate measure of recruitment success, reflecting its impact on organizational performance and talent quality.

- First-Year Attrition: Measures the percentage of new hires who leave the organization within their first year. Because minimizing first-year attrition is crucial for retaining talent investments and avoiding the costs of turnover.

- New Hire Turnover Rate: Tracks the percentage of new hires leaving within a defined period (e.g., 1-2 years). Because low new hire turnover signifies effective recruitment and onboarding processes that lead to long-term employee retention.

- Retention Rate: Measures the percentage of employees who remain with the organization over a specific period. Because a high retention rate indicates overall employee satisfaction and the success of talent management strategies, including recruitment.

- Churn Rate/Attrition Rate/Turnover Rate: These terms are often used interchangeably to measure the rate at which employees leave the organization. Because monitoring churn/attrition/turnover helps identify potential issues with employee satisfaction, retention, and the overall health of the workforce.

- Recruitment Funnel Effectiveness: Assesses how well your recruitment funnel converts candidates from initial application to hire. Because a highly effective funnel maximizes candidate conversion at each stage, optimizing overall hiring yield.

- Sourcing Channel Effectiveness: Evaluates the quality and quantity of hires generated from different recruitment sources. Because understanding sourcing channel effectiveness allows for focusing resources on the most productive channels and optimizing sourcing strategies.

- Sourcing Channel ROI (Return on Investment): Measures the profitability and efficiency of each recruitment source in terms of cost versus the value of hires generated. Because maximizing sourcing channel ROI ensures recruitment investments in sourcing are generating positive returns and optimizing channel selection.

2.4. Satisfaction Metrics

Satisfaction metrics focus on the human element of recruitment, measuring the experiences and perceptions of key stakeholders – candidates and hiring managers. Positive satisfaction scores contribute to employer branding and stronger internal partnerships.

- Candidate Experience: Gauges candidates' overall perception and satisfaction with the entire recruitment process. Because a positive candidate experience enhances employer brand reputation, attracts top talent, and reduces candidate attrition throughout the hiring journey.

- Candidate Net Promoter Score (NPS): Quantifies candidate loyalty and willingness to recommend your company as an employer based on their recruitment experience. Because Candidate NPS provides a direct and quantifiable measure of candidate satisfaction and brand advocacy potential.

- Hiring Manager Satisfaction: Measures hiring managers' satisfaction with the quality of candidates provided and the efficiency of the recruitment process. Because high hiring manager satisfaction indicates effective recruitment service delivery and alignment with internal client needs.

- Candidate Job Satisfaction: Assesses new hires' satisfaction with their roles and the company after they are hired. Because satisfied new hires are more likely to be productive, engaged, and contribute to long-term retention, reflecting the success of the hiring process.

- Employee Experience Score at the Start and After Passing Probation: Tracks employee satisfaction at two key points – onboarding and probation completion – to assess the initial employee journey. Because monitoring employee experience scores throughout early tenure provides valuable insights into onboarding effectiveness and new hire integration.

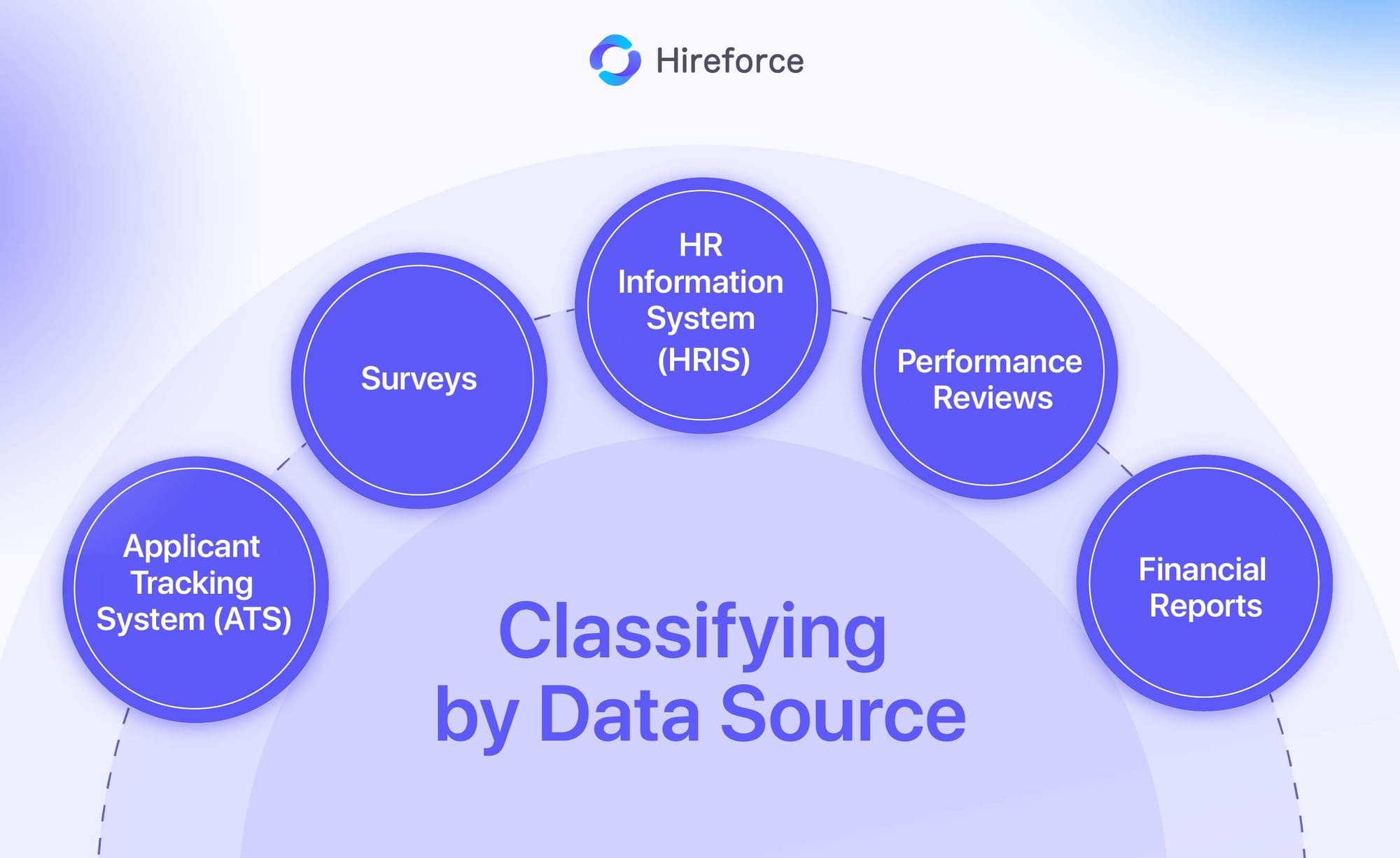

3. Classifying by Data Source - Unlock insights based on where your data lives

Classifying metrics by data source provides a practical perspective, highlighting the tools and systems that provide the raw information for your analysis.

This classification is valuable because it helps you understand the accessibility, reliability, and potential limitations of different data points. Knowing the source also informs how you can collect, analyze, and integrate data from various systems to gain a holistic view of your recruitment performance.

3.1. Applicant Tracking System (ATS)

Your ATS is often the central hub for recruitment data, housing information throughout the candidate journey, from application to hire. It's a primary source for many operational and efficiency metrics.

- Time to Fill: Because ATS systems track dates of requisition, application, offer, and acceptance, making time to fill readily calculable.

- Time to Hire: Similarly, ATS records application and hire dates, providing data for time to hire metrics.

- Source of Hire: ATS platforms often capture candidate source information during the application process, enabling tracking of hire origin.

- Applicants per Role/Opening: ATS can easily count the number of applications received for each job posting, giving applicant volume metrics.

- Selection Ratio: ATS data on candidate progression through stages (e.g., application to interview) allows for calculating selection ratios.

- Offer Acceptance Rate: ATS tracks offer extension and acceptance statuses, facilitating offer acceptance rate calculations.

- Application Completion Rate: ATS can monitor candidate progress through application forms, providing data for completion rates.

- Time in Process Step: Some ATS systems track timestamps at each stage, allowing for measurement of time spent in each step of the process.

- Fill Rate: By tracking requisitions and hires, ATS data enables the calculation of fill rates.

3.2. Surveys

Surveys are essential for capturing qualitative data and subjective experiences, particularly around candidate and hiring manager satisfaction.

- Candidate Experience: Candidate surveys, often administered post-application or post-interview, directly capture candidate feedback on their experience.

- Candidate Net Promoter Score (NPS): NPS surveys, specifically designed to measure likelihood to recommend, are a key tool for quantifying candidate sentiment.

- Hiring Manager Satisfaction: Surveys distributed to hiring managers after a hire (or after interacting with recruiters) capture their satisfaction levels.

- Candidate Job Satisfaction: Surveys sent to new hires after they start or after probation capture their initial job satisfaction.

3.3. HR Information System (HRIS)

Once candidates become employees, your HRIS becomes a crucial data source, particularly for metrics related to employee performance, retention, and demographics.

- First-Year Attrition: HRIS systems track employee start and end dates, making first-year attrition easily measurable.

- New Hire Turnover Rate: HRIS data over longer periods enables calculation of new hire turnover rates.

- Retention Rate: HRIS is the primary source for calculating overall employee retention rates, using employee start and end dates.

- Churn Rate/Attrition Rate/Turnover Rate: HRIS data provides the foundation for calculating these related employee departure metrics.

- Diversity & Inclusion (D&I) / DEI / DEIB Metrics: HRIS systems often store employee demographic data, enabling the tracking of diversity and inclusion metrics.

- Employee Experience Score at the Start and After Passing Probation: Employee surveys integrated with or tracked alongside HRIS data can provide employee experience scores at key milestones.

3.4. Performance Reviews

Performance review data, while often more qualitative, can be crucial for assessing the long-term success and quality of hires.

- Quality of Hire: Performance review ratings and feedback, gathered from hiring managers over time, are often a key component of quality of hire assessments.

- Time to Productivity: Performance reviews and manager feedback can contribute to assessing how quickly new hires reach expected productivity levels.

3.5. Financial Reports

To understand the financial impact of recruitment, you'll need to tap into your organization's financial data and reporting systems.

- Cost per Hire: Financial systems provide data on direct recruitment expenses (advertising, agency fees, etc.) and internal costs (recruiter salaries), necessary for calculating cost per hire.

- Cost to Fill: Financial reports, combined with HR data, can be used to calculate the fully loaded cost of filling vacancies, including indirect costs.

- Recruitment ROI (Return on Investment): Financial data on revenue generated by new hires or cost savings attributed to effective recruitment, combined with recruitment cost data, allows for ROI calculations.

- Sourcing Channel Cost: Financial systems track invoices and expenses related to different sourcing channels, enabling the calculation of sourcing channel costs.

By understanding these data sources and the metrics they provide, you can develop a more strategic approach to recruitment analytics. You can identify data gaps, ensure data integrity, and build a more comprehensive and insightful recruitment measurement framework.

4. Classifying by Role - Understand different stakeholder perspectives

Recruitment is a collaborative effort, involving various stakeholders with distinct responsibilities and perspectives. Classifying metrics by role helps you tailor your measurement approach to resonate with different individuals and understand their specific contributions and concerns.

This perspective is valuable because it ensures that metrics are not just abstract numbers, but meaningful indicators that drive action and accountability at each level of the recruitment process. By considering role-based classifications, you can communicate insights more effectively and foster a shared understanding of recruitment performance across the organization.

4.1. Recruiters

Recruiters are on the front lines of talent acquisition, directly managing the candidate journey and striving for efficient and high-quality hires. For recruiters, key metrics often revolve around process efficiency, candidate experience, and their direct contribution to hire quality.

- Time to Fill: Because recruiters are directly responsible for managing the hiring process timeline, time to fill is a key metric of their efficiency.

- Cost per Hire: Recruiters often manage aspects of recruitment spending, making cost per hire a relevant metric for their operational efficiency.

- Quality of Hire: While a broader organizational metric, recruiters contribute significantly to quality of hire through effective sourcing, screening, and candidate assessment.

- Offer Acceptance Rate: A recruiter's ability to effectively sell the opportunity and manage candidate relationships directly impacts offer acceptance rates, making it a key performance indicator.

- Candidate Experience: Recruiters are the primary point of contact for candidates, and candidate experience scores directly reflect their communication and relationship-building skills.

- Sourcing Channel Effectiveness: Recruiters often specialize in or utilize specific sourcing channels, making sourcing channel effectiveness a metric that reflects their sourcing expertise.

4.2. Hiring Managers

Hiring managers are the internal clients of the recruitment function. They are primarily concerned with the quality of talent they receive and how quickly new hires become productive in their teams. For hiring managers, key metrics often center on hire quality, time to productivity, and their satisfaction with the recruitment process.

- Quality of Hire: Ultimately, hiring managers are most impacted by the quality of new team members, making quality of hire a top-priority metric from their perspective.

- Time to Productivity: Hiring managers need new team members to become productive quickly to meet team goals, making time to productivity a critical metric for their operational needs.

- Hiring Manager Satisfaction: Direct feedback from hiring managers provides valuable insight into how well recruitment is meeting their specific needs and expectations.

4.3. Talent Acquisition Leaders/HR Leadership

Leaders in Talent Acquisition and HR take a strategic, overarching view of recruitment. They are concerned with the overall performance of the recruitment function, its ROI, and its contribution to broader organizational goals, including diversity and inclusion. For leadership, key metrics often focus on strategic impact, efficiency at scale, and alignment with business objectives.

- Recruitment ROI (Return on Investment): TA leaders are accountable for demonstrating the value and financial return of the entire recruitment function, making Recruitment ROI a crucial leadership-level metric.

- Overall Recruitment Efficiency and Effectiveness: Leaders need to monitor aggregate metrics that reflect the overall health and performance of the recruitment function, encompassing both efficiency and effectiveness.

- Diversity & Inclusion (D&I) Metrics: Organizational diversity and inclusion goals are often driven from the leadership level, making D&I metrics essential for tracking progress and ensuring strategic alignment.

- Number of Open Positions & Percentage of Open Positions: These metrics provide a high-level view of the organization's overall hiring demand and the recruitment function's ability to meet that demand at scale, relevant for strategic workforce planning.

By classifying metrics by role, you create a more relevant and actionable measurement framework. It allows you to communicate performance insights in a way that resonates with each stakeholder group, fostering collaboration and driving targeted improvements across the entire recruitment ecosystem.

5. Classifying by Stage of Hiring Process - Well measure for each phase of your recruitment funnel

The recruitment process is rarely a linear event, it's a journey with distinct stages, each requiring focused attention and optimization. Classifying metrics by stage in the hiring process provides a granular view of your recruitment funnel, allowing you to pinpoint bottlenecks, improve candidate flow, and enhance efficiency at every touchpoint.

This approach is invaluable for identifying specific areas for improvement within your recruitment process and ensuring a smooth and effective candidate journey from initial awareness to onboarding. Let's explore key metrics across the typical stages of a recruitment funnel:

5.1. Awareness & Attraction

The initial stage is about making potential candidates aware of your company and attracting them to your open roles. Metrics here focus on visibility, reach, and initial candidate engagement.

- Source of Hire: Because understanding where your successful candidates originate helps optimize your sourcing strategies and allocate resources to the most effective channels for initial awareness.

- Sourcing Channel Effectiveness: Evaluating the performance of different channels in generating awareness and attracting qualified candidates is crucial for efficient sourcing.

- Sourcing Channel Cost: Tracking costs associated with each channel in the awareness phase helps ensure cost-effective attraction strategies.

- Sourcing Channel ROI: Measuring the return on investment for each sourcing channel in the awareness stage helps prioritize channels that deliver the best value.

- Applicants per Opening: Monitoring applicants per opening at this stage provides an early indicator of role attractiveness and the breadth of your initial reach.

- Candidate Engagement: Tracking candidate engagement with your employer branding content and job postings measures the effectiveness of your attraction efforts in generating initial interest.

5.2. Interest & Application

Once candidates are aware, the next stage focuses on capturing their interest and facilitating a smooth application process. Metrics here measure application ease, candidate experience during application, and initial conversion.

- Application Completion Rate: Because a high application completion rate ensures you capture the maximum number of interested candidates, and a low rate indicates potential barriers in your application process.

- Candidate Experience: Assessing candidate experience during the application stage is crucial as it forms the first direct interaction candidates have with your company, influencing their overall perception.

- Candidate Net Promoter Score (NPS): Measuring Candidate NPS even at the application stage provides early feedback on candidate sentiment and brand perception.

- Test Completion Rate: For roles involving assessments, tracking test completion rate ensures candidates are progressing through the initial screening stages as expected.

5.3. Screening & Selection

This stage involves evaluating candidates, shortlisting, and interviewing to identify the best fit. Metrics here focus on efficiency, effectiveness of screening methods, and fairness.

- Selection Ratio: Because selection ratio at the screening stage helps assess the effectiveness of your initial screening criteria in filtering candidates efficiently.

- Conversion Ratio (through each stage): Tracking conversion ratios between each stage of screening and selection pinpoints bottlenecks and areas for process optimization within the funnel.

- Recruitment Funnel Effectiveness: Analyzing the overall effectiveness of your recruitment funnel in converting applicants to interviews and ultimately to offers is crucial for process efficiency.

- Recruitment Funnel Speed: Monitoring funnel speed during screening and selection ensures a timely progression of candidates and reduces time-to-hire.

- Time in Process Step: Measuring time spent at each screening and selection step helps identify delays and streamline the evaluation process.

- Interview to Hire Ratio: Analyzing interview to hire ratio helps assess the effectiveness of your interview process in identifying successful candidates.

- Adverse Impact: Monitoring for adverse impact during screening and selection is crucial for ensuring fair and unbiased evaluation processes.

- Diversity & Inclusion (D&I) / DEI / DEIB Metrics: Tracking diversity metrics throughout screening and selection ensures equitable representation at each stage of the funnel.

- Candidate Diversity: Monitoring candidate diversity within the screened and selected pools helps assess the diversity outcomes of your evaluation process.

5.4. Offer & Hiring

This stage focuses on extending offers, securing acceptances, and finalizing the hiring process. Metrics here measure offer success, speed of offer process, and reasons for offer declines.

- Offer Acceptance Rate: Because a high offer acceptance rate signifies competitive offers and effective candidate relationship management in the final stages.

- Days to a Job Offer: Minimizing days to offer ensures a swift and positive candidate experience and reduces the risk of losing candidates to competing offers.

- Candidate Withdrawal/Rejection Reasons: Analyzing reasons for offer withdrawals and rejections provides critical feedback on compensation, offer terms, and candidate perceptions at the final stage.

- Cost per Hire: Tracking cost per hire at this stage provides a comprehensive view of the financial investment required to reach a successful hire.

- Cost to Fill: Understanding the fully loaded cost to fill, including offer and hiring activities, is crucial for complete budget analysis.

- Time to Fill: Measuring time to fill overall, including the offer stage, reflects end-to-end recruitment cycle efficiency.

- Time to Hire: Monitoring time to hire, encompassing offer and hiring steps, tracks the entire candidate journey duration.

- Fill Rate: Fill rate for this stage confirms successful completion of the hiring process and meeting hiring targets.

- Number of Hires: Tracking the number of hires in this stage confirms the volume of successful offer conversions.

5.5. Onboarding & Retention

While technically post-hire, the onboarding phase is crucial for setting new hires up for success and impacting long-term retention. Metrics here bridge recruitment and employee lifecycle, focusing on initial performance, satisfaction, and early retention.

- First-Year Attrition: Because first-year attrition is heavily influenced by the onboarding experience, tracking it provides feedback on onboarding effectiveness.

- New Hire Turnover Rate: Monitoring new hire turnover over a longer period highlights the long-term impact of onboarding and initial job fit.

- Quality of Hire: Assessing quality of hire, even in the early stages, reflects the effectiveness of the entire recruitment and onboarding process in selecting and integrating successful employees.

- Time to Productivity: Minimizing time to productivity is a key goal of effective onboarding, making it a crucial metric at this stage.

- Cost of getting to Optimum Productivity Level (OPL): Understanding the investment required to bring new hires to full productivity helps optimize onboarding programs and resource allocation.

- Hiring Manager Satisfaction: Hiring manager satisfaction post-onboarding provides feedback on the overall effectiveness of the recruitment and onboarding process in meeting their team's needs.

- Candidate Job Satisfaction: Measuring candidate job satisfaction after onboarding assesses the initial fulfillment of candidate expectations and the effectiveness of the onboarding experience.

- Retention Rate: Longer-term retention rates are ultimately influenced by effective onboarding, making it a relevant metric to monitor in this stage.

- Churn Rate/Attrition Rate/Turnover Rate: Overall employee departure rates are impacted by onboarding experiences, making these metrics relevant for long-term evaluation.

- Probation Passing: Probation passing rate provides an early and tangible indicator of onboarding success and initial job performance.

- Employee Experience Score at the Start and After Passing Probation: Tracking employee experience scores through onboarding and probation provides direct feedback on the onboarding process and new hire integration.

By classifying metrics by stage in the hiring process, you gain a powerful framework for process optimization. You can identify stage-specific bottlenecks, benchmark performance at each phase, and implement targeted improvements to create a more efficient, effective, and candidate-centric recruitment journey.

Key Takeaways

- Throughout this article, we've examined five essential ways to classify recruitment metrics: by Business Objective, Level of Measurement, Data Source, Role, and Stage in the Hiring Process. Each classification offers a unique lens through which to analyze your recruitment data, providing different perspectives and actionable insights.

- By Business Objective: Aligning metrics with strategic goals ensures recruitment directly contributes to organizational priorities like cost efficiency, time optimization, quality of hire, candidate experience, and diversity & inclusion.

- By Level of Measurement: Categorizing by activity, efficiency, effectiveness, and satisfaction provides a multi-faceted view of performance, moving beyond simple counts to understand impact and value.

- By Data Source: Understanding where your data originates, whether from your ATS, surveys, HRIS, financial reports, or performance reviews, informs data accessibility, reliability, and integration strategies.

- By Role: Role-based classifications – recruiter, hiring manager, TA leader – ensure metrics are relevant and actionable for different stakeholders, fostering accountability and collaboration across the recruitment ecosystem.

- By Stage in the Hiring Process: Stage-specific metrics provide a granular view of your recruitment funnel, allowing you to pinpoint bottlenecks and optimize each phase of the candidate journey, from awareness to onboarding.

- For organizations seeking a practical starting point, especially those leveraging technology to streamline their hiring, classification by Data Source offers a particularly valuable approach. As Hireforce, a fully integrated solution of Applicant Tracking Systems, understands, your ATS is a goldmine of recruitment data. Classifying metrics based on whether they originate from your ATS, surveys, HRIS, or other sources helps you leverage your existing technology investments and build a data-driven recruitment strategy from the ground up.

- The ultimate advice is to think clearly about your business needs and choose the classifications that best serve your unique context. Consider what insights are most critical for your organization, who needs to act on those insights, and what aspects of your recruitment process require the most attention. Experiment with different classifications, combine them for a more holistic view, and continuously refine your approach as your business evolves and your recruitment strategy matures.

About Hireforce

Hireforce is a next-generation Applicant Tracking System (ATS) platform built for HR professionals who seek efficiency, collaboration, and data-driven decision-making in recruitment. Designed to streamline the hiring process, Hireforce offers features empowering recruiters to source, track, and hire top talent quickly and efficiently.

Key features of Hireforce:

- Customizable hiring pipelines with drag-and-drop Kanban functionality.

- Automated workflows that reduce repetitive tasks, saving time and increasing efficiency.

- Advanced analytics to track recruiter performance, hiring funnels, and team productivity.

- Collaborative tools like team notes, interview scheduling, and evaluation forms ensure seamless communication across hiring teams.

- It enhanced candidate experience with mobile-friendly applications, branded career pages, and self-scheduling features.

For teams looking to elevate their recruitment process, Hireforce is the ideal partner to power up hiring success, regardless of size or industry. We offer a flexible pricing structure that charges based on the number of users, reducing costs and offering more competitive pricing than most competitors.